ETH Price Prediction: Will Ethereum Surge Past $4,000?

#ETH

- Technical Strength: ETH trades above key moving averages with positive MACD momentum.

- Institutional Demand: BlackRock's ETF and treasury expansions signal long-term confidence.

- Price Target: $4,000 is achievable if $3,300 support holds, per analyst consensus.

ETH Price Prediction

Ethereum Technical Analysis: Key Indicators to Watch

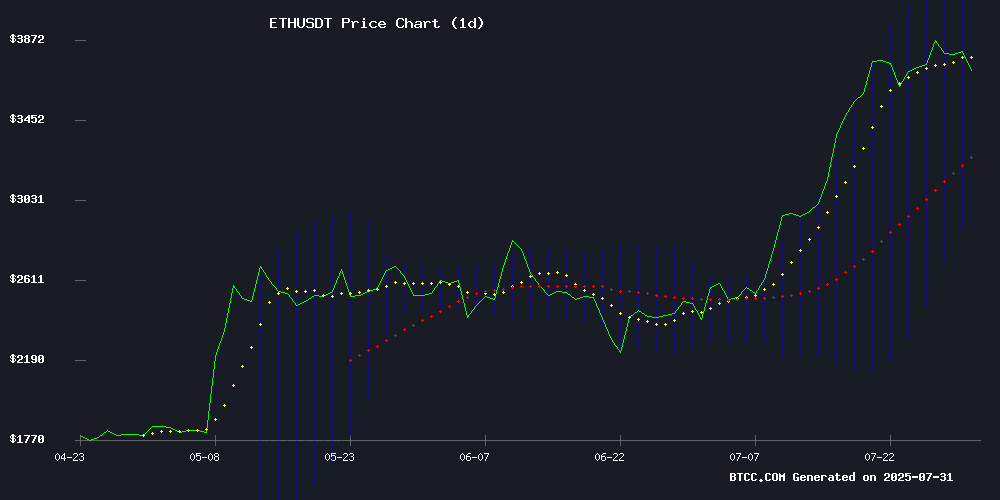

According to BTCC financial analyst James, ethereum (ETH) is currently trading at $3,860.69, above its 20-day moving average (MA) of $3,562.80, indicating a bullish trend. The MACD histogram shows a positive divergence at 62.4469, suggesting potential upward momentum. Bollinger Bands reveal the price is closer to the upper band at $4,164.30, signaling strong buying interest. James notes that if ETH maintains support above $3,300, a surge toward $4,000 is plausible.

Ethereum Market Sentiment: Institutional Demand and Bullish Predictions

BTCC analyst James highlights strong institutional interest in Ethereum, with BlackRock's ETF now holding over 3M ETH. News of Ether Machine's $56.9M purchase and BTCS's $2B treasury expansion further fuels bullish sentiment. James points out that if key support levels hold, ETH could test $5,140, as predicted by some analysts. However, regulatory uncertainty around the Tornado Cash trial may introduce short-term volatility.

Factors Influencing ETH’s Price

Ether Machine Expands ETH Treasury with $56.9M Purchase, Holdings Surpass $1.2B

Ether Machine marked Ethereum's 10th anniversary with a strategic acquisition of 15,000 ETH for $56.9 million, executed through its subsidiary Ether Reserve LLC at an average price of $3,809.97 per token. The move elevates the firm's total ETH holdings to 334,757—a $1.2 billion position at current valuations—with an additional $407 million earmarked for future accumulation.

Chairman Andrew Keys framed the purchase as institutional-grade treasury deployment, calling Ethereum "the backbone of a decentralized internet." The firm concurrently donated $100,000 to Ethereum's Protocol Guild and signaled further buys using residual funds from a $97 million private placement. Corporate ETH accumulation appears to be gaining momentum, though the announcement didn't disclose which exchanges facilitated the transactions.

All Eyes on Ethereum: Price Prediction for Next Week

Ethereum (ETH) is poised for a potential breakout, with analysts forecasting an 11% climb to $4,200 by August 2. Institutional inflows, on-chain strength, and improving trader sentiment are driving the bullish momentum. ETH currently holds firm above $3,800, with gradual gains expected to accelerate later in the week.

Retail capital is rotating into high-velocity altcoins like MAGACOIN FINANCE, seeking faster upside during Ethereum's steady rise. The market structure reflects textbook bullish consolidation, with neutral funding rates and no excessive leverage buildup signaling healthy conditions for a breakout.

Early Ethereum Investors Turned Small Bets Into Massive Profit: Could History Repeat?

In 2014, Ethereum’s presale offered ETH at under $0.35—a price now considered absurdly low. Few outside developer circles noticed. Those who invested modest sums, like $500 or $1,000, reaped life-changing returns as Ethereum ascended to become the second-largest cryptocurrency. These were not institutional players but ordinary believers.

Today, analysts spot parallels in MAGACOIN FINANCE, a new presale token exhibiting similar early dynamics: cultural resonance, viral growth, deflationary mechanics, and a rapidly expanding community. Ethereum’s rise was gradual, fueled by programmers and Web3 pioneers—not institutions. Early conviction laid the groundwork for utility and price appreciation.

The takeaway remains unchanged: crypto fortunes favor those who act early, particularly during presales. History may yet repeat.

Jury Deliberations Begin in Roman Storm's Tornado Cash Money Laundering Trial

Manhattan jurors are now weighing whether Tornado Cash developer Roman Storm facilitated the laundering of over $1 billion for cybercriminals, including North Korean hackers. Prosecutors allege Storm and his co-founders knowingly enabled illicit activity, citing ignored victim pleas and immutable smart contracts as evidence of willful negligence.

The defense maintains Storm operated within legal boundaries, emphasizing the decentralized nature of crypto mixing services. Closing arguments hinged on whether Storm's control over Tornado Cash's frontend constituted criminal intent—a pivotal question for privacy tools in DeFi.

Analyst Predicts Ethereum Surge to $5,140 if $3,300 Support Holds

Ethereum hovers at $3,749 as traders await the Federal Reserve's interest rate decision, with market sentiment cautiously optimistic. The asset recently tested $3,941 before retracing—a move analysts interpret as consolidation before the next leg up.

Technical thresholds dominate the conversation. The $3,300 level emerges as a critical litmus test for bullish continuity. A sustained hold above this support could catalyze rallies toward $4,220 and ultimately $5,140, according to on-chain metrics tracking investor behavior.

Market structure appears to favor accumulation. The MVRV Pricing Bands indicator suggests Ethereum remains in a profit-taking sweet spot—not overbought enough to trigger mass exits, yet not oversold enough to indicate weakness. This equilibrium often precedes volatile expansions when combined with strong fundamentals.

BlackRock Ethereum ETF Surpasses 3M ETH Holdings as Institutional Demand Soars

BlackRock's Ethereum ETF has crossed a significant milestone, accumulating over 3 million ETH in holdings following a substantial purchase of 59,309 ETH on July 29. The fund's assets under management now exceed $11.1 billion, reflecting robust institutional interest.

ETHA shares have surged 50% this month, approaching the $30 mark. Inflows into the Ethereum ETF outpaced daily ETH issuance by 24 times, underscoring overwhelming demand. On July 29 alone, ETHA contributed $223 million in net inflows, leading the Ethereum ETF market.

July proved transformative for the fund, with BlackRock adding more than 1.23 million ETH—accounting for over 40% of its total holdings. The growing AUM and share price appreciation signal deepening institutional confidence in Ethereum's long-term value proposition.

BTCS Files to Raise $2B for Ethereum Treasury Expansion

Nasdaq-listed blockchain firm BTCS has filed a shelf registration with the SEC, paving the way for potential capital raises totaling $2 billion. The funds would primarily bolster the company's Ethereum treasury strategy, enabling additional ETH acquisitions or staking operations expansion.

BTCS currently holds 70,000 ETH ($265 million) as part of its pioneering crypto treasury approach initiated in 2021. The company's recent inclusion in the Russell Microcap Index underscores its growing institutional profile within digital asset markets.

The shelf registration provides flexibility for future securities offerings without immediate commitment. Specific terms would be disclosed in subsequent prospectus supplements, allowing BTCS to capitalize on favorable market conditions for Ethereum-related investments.

Ethereum's Invisible Infrastructure Dilemma

Ethereum has cemented its position as the backbone of decentralized finance, enabling programmable money and tokenization of real-world assets. Yet its very success now threatens to render it invisible—a paradox for the network that pioneered DeFi.

The platform's evolution into a pure settlement layer, while technically elegant, distances end-users from its core infrastructure. Recent upgrades like EIP-4844's blobspace enhance scalability but further obscure Ethereum's presence behind layers of abstraction.

This architectural triumph comes with economic consequences. ETH's valuation currently depends on three precarious pillars: transaction fees, staking rewards, and blobspace payments—all vulnerable to market forces and potential migration to competing chains.

Fundamental Global Inc. (FGF) Plunges 70% After $200M Ethereum Treasury Pivot and Rebrand to FG Nexus

Fundamental Global Inc. (FGF) shares collapsed from nearly $70 to $20 in early trading Tuesday following the announcement of a $200 million Ethereum treasury strategy and corporate rebranding. The stock traded at $20.30 by mid-morning, reflecting a 5.63% daily decline.

The company revealed a private placement of 40 million prefunded warrants at $5.00 each to fund its Ethereum-focused treasury shift. This strategic pivot positions the newly renamed FG Nexus as a capital markets platform centered on Ethereum's growing role in finance and tokenized assets.

Market reaction was immediate and severe, with the 70% plunge reflecting investor skepticism about the dramatic shift from traditional assets to cryptocurrency exposure. The warrants structure accommodates both fiat and cryptocurrency participation, underscoring the hybrid nature of the transition.

BlackRock’s Ethereum ETF Staking Proposal Advances Amid SEC Review

The U.S. Securities and Exchange Commission has taken a pivotal step toward enabling staking for BlackRock's proposed iShares Ethereum Trust (ETHA). Nasdaq's rule-change filing, now under formal review, could allow the fund to participate in Ethereum's proof-of-stake network—marking a potential watershed moment for crypto-based income products.

Approval would permit BlackRock to stake the ETF's underlying ETH holdings, with rewards flowing to shareholders as segregated income. The SEC's 45-day decision window leaves room for delays, as seen with pending applications from Bitwise and Grayscale. Market observers note this development signals growing institutional embrace of blockchain's yield-generating capabilities.

FG Nexus Launches $200M Ether Treasury Strategy Backed by Galaxy Digital, Kraken

Nasdaq-listed Fundamental Global (FGF) has rebranded as FG Nexus, marking its entry into digital assets with a $200 million private placement to fund an ether-based treasury strategy. The offering, priced at $5 per prefunded warrant, attracted heavyweight backers including Galaxy Digital, Kraken, and Digital Currency Group.

Galaxy Digital will advise on treasury management and staking infrastructure, while Kraken handles staking operations. Proceeds will be deployed to accumulate ETH as a reserve asset, capturing staking yields and exposure to tokenized real-world assets.

The move positions FG Nexus alongside public companies like Bit Digital and SharpLink Gaming in betting on Ethereum as the institutional settlement layer of choice. Former TD Ameritrade CEO Joe Moglia joins as executive advisor, with blockchain veteran Maja Vujinovic leading the digital asset strategy.

Will ETH Price Hit 4000?

Based on technical indicators and market sentiment, BTCC analyst James believes ETH has a strong chance of reaching $4,000. Key factors include:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $3,860.69 | Bullish above 20-day MA |

| MACD | 62.4469 (Positive) | Upward momentum |

| Bollinger Bands | Upper: $4,164.30 | Potential resistance |

Institutional demand and ETF growth further support this outlook.